38+ mortgage interest tax deduction limit

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. How It Works in 2022 The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers.

Mortgage Interest Tax Deduction Smartasset Com

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Taxes Can Be Complex. The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web To be perfectly clear the mortgage interest deduction can only be used by a homeowner if they choose to itemize deductions on their return. Web Mortgage-Interest Deduction.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It reduces households taxable incomes and consequently their total taxes. Web If youve closed on a mortgage on or after Jan.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. You cant deduct the principal the borrowed money youre paying back. Web How a Mortgage Interest Deduction Works.

Web Having said that there should still be some deductible interest. Generally with a loan limit of 750K average loan balance of 850K yields a percentage of. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web What is the mortgage interest tax deduction limit for a second home. You can claim a tax deduction for the interest on the first. The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your.

You Could Get a Refund Advance Loan within Minutes After You File with HR Block. Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second. Homeowners who bought houses before.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web The IRS places several limits on the amount of interest that you can deduct each year. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. The limit on mortgage. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

The limit on deductions is shared between up to two personal residences. Homeowners who are married but filing. Schedule Your Tax Appointment Today.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Benefits of the mortgage interest deduction. Taxes Can Be Complex.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web Interest on loans from utility companies is deductible when the loan is used to purchase and install energy-efficient equipment or products. Ad See Why People Love Refund Advance At HR Block.

Web Mortgage Interest Deduction Limit. For tax years before 2018 the interest paid on up to 1 million of acquisition. For tax year 2022 those amounts are rising to.

Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web The IRS lets you deduct your mortgage interest but only if you itemize deductions. Say you have a 200k mortgage Jan-June 2022 then you sell that house buy a new one and have an 800k mortgage from July 1-present.

If you take the. Web Is there a limit to the amount I can deduct.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Save When Filing Your Taxes

Filing Taxes Home Mortgage Interest Tax Deduction Onhike

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction A 2022 Guide Credible

Scientific Bulletin

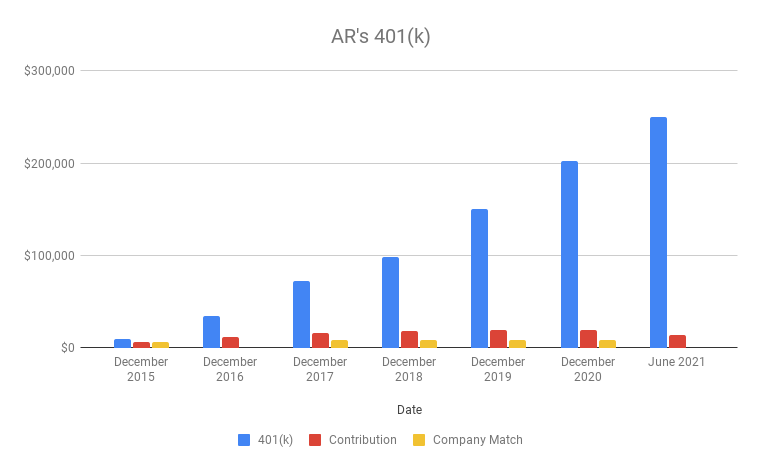

Why You Should Max Out Your 401 K In Your 30s

Mortgage Interest Deduction Bankrate

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Tumbi Umbi Mortgage Choice Central Coast Mortgage Choice

How Much Of The Mortgage Interest Is Tax Deductible Home Loans